An interview with Eisaiah Engel about increasing the odds of success of corporate innovation

“Google writes, ‘True innovation happens when you try to improve something by 10X rather than by 10%.’ Yet, bureaucracy is designed to prevent 10X innovation. To overcome organizational roadblocks, CEOs should focus exclusively on their core products—transforming them into digital ecosystems where external companies can build everything else. Such is playing like the ‘house’ in the innovation casino”

Eisaiah Engel, author of Innovation Casino

Key take-aways

- Corporate innovation success rates are at best patchy. How can my company’s innovation strategy produce better results at times when a lot of innovation is happening in start-ups?

- In start-ups, the challenge is not having enough capital. In corporates, the challenge is complex processes get in the way. The solution is to bridge these two worlds through an Ecosystem Innovation Fund (EIF), which is a cross between the US government grant program called “SBIR” (Small Business Innovation Research) and corporate venture capital (CVC).

- The results of this new approach not only surpass those of both SBIR and CVC, but creates an innovation blueprint that is fit for the new world of digital ecosystems.

INTERVIEW

Omar Valdez-de-Leon (OV): First, tell me a little bit about you and your work on corporate innovation.

Eisaiah Engel (EE): My latest book, Innovation Casino, is my answer to a question I have repeatedly asked since leaving my start-up to work for large firms. That question is, “How can this company’s innovation strategy produce better results?”

I grew up in San Diego and started my career there. At the time, nearly six in ten San Diego businesses had four workers or less. It was an entrepreneurial city. In that environment, I started three companies before my 30th birthday. Then, I moved to Dallas to work with larger companies. I have been with a Fortune 10 firm for the last four years.

To my surprise, it has not been easier to launch new products, services, or processes in large companies despite having more resources. In my startups, the challenge was not having enough capital. In larger firms, the challenge is too many people and processes get in the way. I wrote Innovation Casino to propose a solution to overcome both obstacles by bridging the gaps between these two seemingly opposite worlds. The solution is an ecosystem innovation fund, which is a cross between a US government grant program called “SBIR” (Small Business Innovation Research) and corporate venture capital.

OV: Tell me more about the idea of an ecosystem innovation fund.

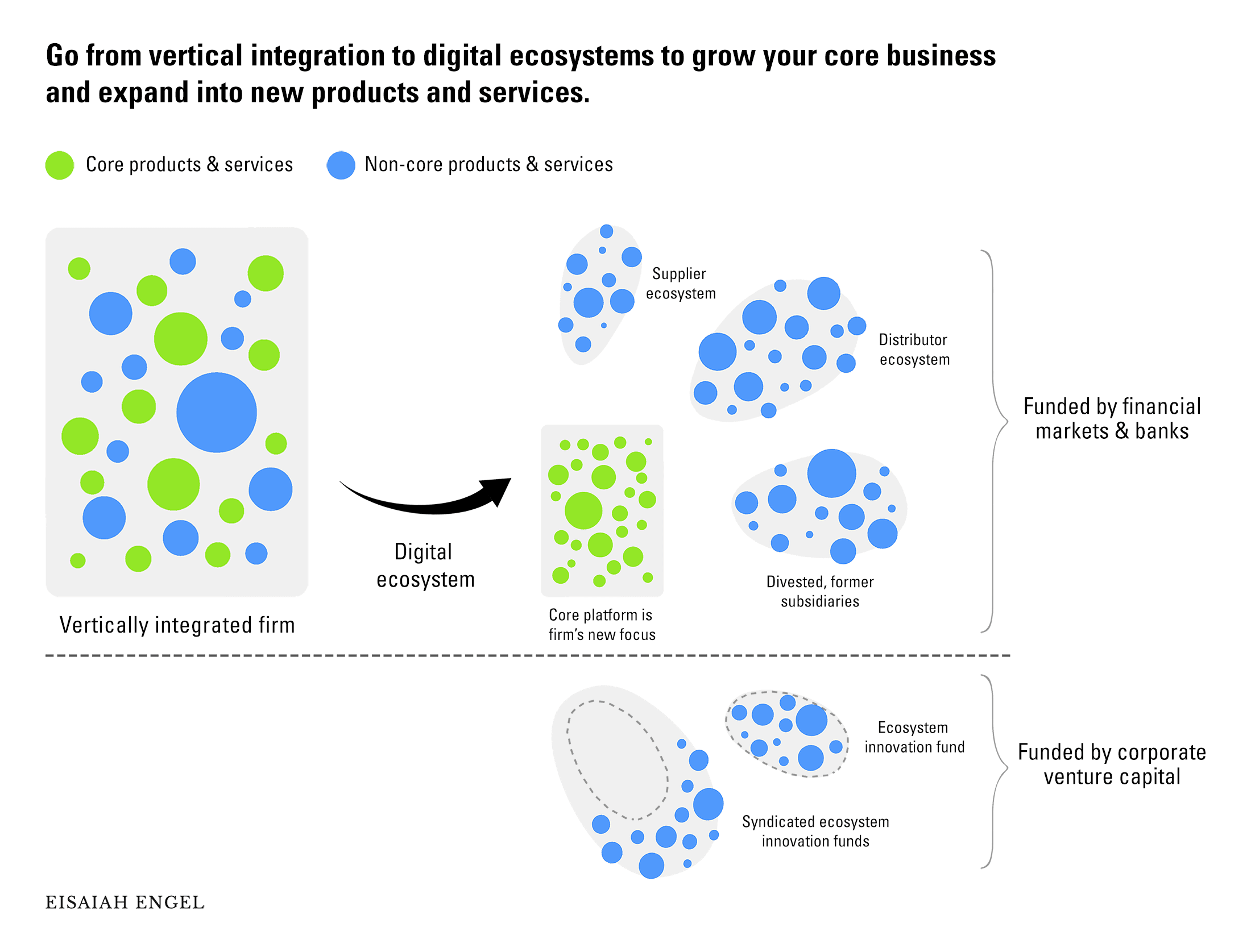

EE: Too much vertical integration over the last decade has bloated the employee counts and debt obligations of large firms, making them less productive. To become productive again, companies need to refocus on what is core—striving to make core offerings 10X better and transforming core offerings into platforms where external firms can plug in. Your core platform and the external firms building on it together form a digital ecosystem. The purpose of an ecosystem innovation fund is to attract start-ups to your digital ecosystem. Start-ups tend to have better commercial outcomes from innovation than established small businesses. That is a finding from the US National Science Foundation’s SBIR grant program. So, the more start-ups you have building on your platform, the more reasons customers have to use your digital ecosystem versus that of the competition.

An ecosystem innovation fund works by transferring the best practices of the SBIR grant program to corporate venture capital. SBIR funding has helped spark more than 70,000 patents, 700 publicly traded companies, and $41 billion in follow-on venture capital financing since its inception in 1982. As a grant program, SBIR is missing straight-forward ways to recoup principal and generate a return on capital. For this piece of the puzzle, we look to venture capital, which buys equity in start-ups instead of giving grants.

The best practices of SBIR and corporate venture capital can be combined because the programs resemble each other.

| Best practices of SBIR and corporate venture capital | SBIR | Corporate VC |

| % of parent company or agency R&D budgets | 3.2% | 4% |

| Balances innovation with commercialization | ✓ | ✓ |

| Focuses on strategic value first, and then financial returns | ✓ | ✓ |

| Provides distribution and support for the start-ups they fund | ✓ | ✓ |

“The purpose of an ecosystem innovation fund is to attract start-ups to your digital ecosystem… the more start-ups you have building on your platform, the more reasons customers have to use your digital ecosystem versus that of the competition.”

OV: Why should companies adopt this corporate innovation strategy?

EE: Peter Atwater, a renowned researcher of financial markets, says we are living in an “Age of Illusion.” Atwater coined the term to describe the last 10 years of blitzscaling, moving fast and breaking things, and ever-increasing acts of deception such as WeWork, Wirecard, Luckin Coffee, Nikola, and Greensill Capital—and the prices of meme stocks such as Bed Bath & Beyond, AMC, and GameStop. “It may not be this week or this month,” Atwater writes, “but when the Age of Illusion is revealed for what it has been, the anger will be intense.” The political blowback from the Age of Illusion will impact monetary and fiscal policy. Even the most honest companies will be impacted by the policy changes. After a decade at historic lows, interest rates and taxes will tick higher and choke debt-laden companies, many of which are today’s corporate giants. To survive after the Age of Illusion, large companies will need to refocus on what is core.

Core goods and services are what a company excels at producing. No single person, company, or even country can be great at everything. That is why there is trade. However, the capital markets of the 2010s distorted fundamentals and incentivized CEOs to chase topline growth rather than profits. Companies bet big on acquisitions to grow, then found themselves operating outside of their core competencies. Such is the strategy of “players” in the innovation casino. Conversely, improving your core offerings by 10X and supporting worthy non-core ideas with an ecosystem innovation fund (instead of internal teams) is playing the innovation casino like the “house.” When the next bear market finally comes along, companies that play like the “house” will have the highest odds at securing financing and expanding market share.

Your core offerings are where every dollar you invest of shareholder capital has a chance to beat the market. Beating the market is, after all, the purpose of shareholders buying your stock versus indexing the broader market. Still, great non-core ideas will come along, and you do not have to turn them down. Your ecosystem innovation fund can help you find startups to build promising non-core ideas as “apps” on your platform. That way, customers can still get products and services that complement your core platform. And your firm does not have to build everything by itself. As digitalization reaches maturity across industries, and as we move from value chains to digital ecosystems, developing these ecosystems will become a core competency. In fact, Omar, your 2019 paper gives business leaders a practical framework for developing digital ecosystems. I cited your paper in Innovation Casino.

“Your ecosystem innovation fund can help you find start-ups to build promising non-core ideas as “apps” on your platform. That way, customers can still get products and services that complement your core platform.”

OV: How does an ecosystem innovation fund differ from corporate venturing?

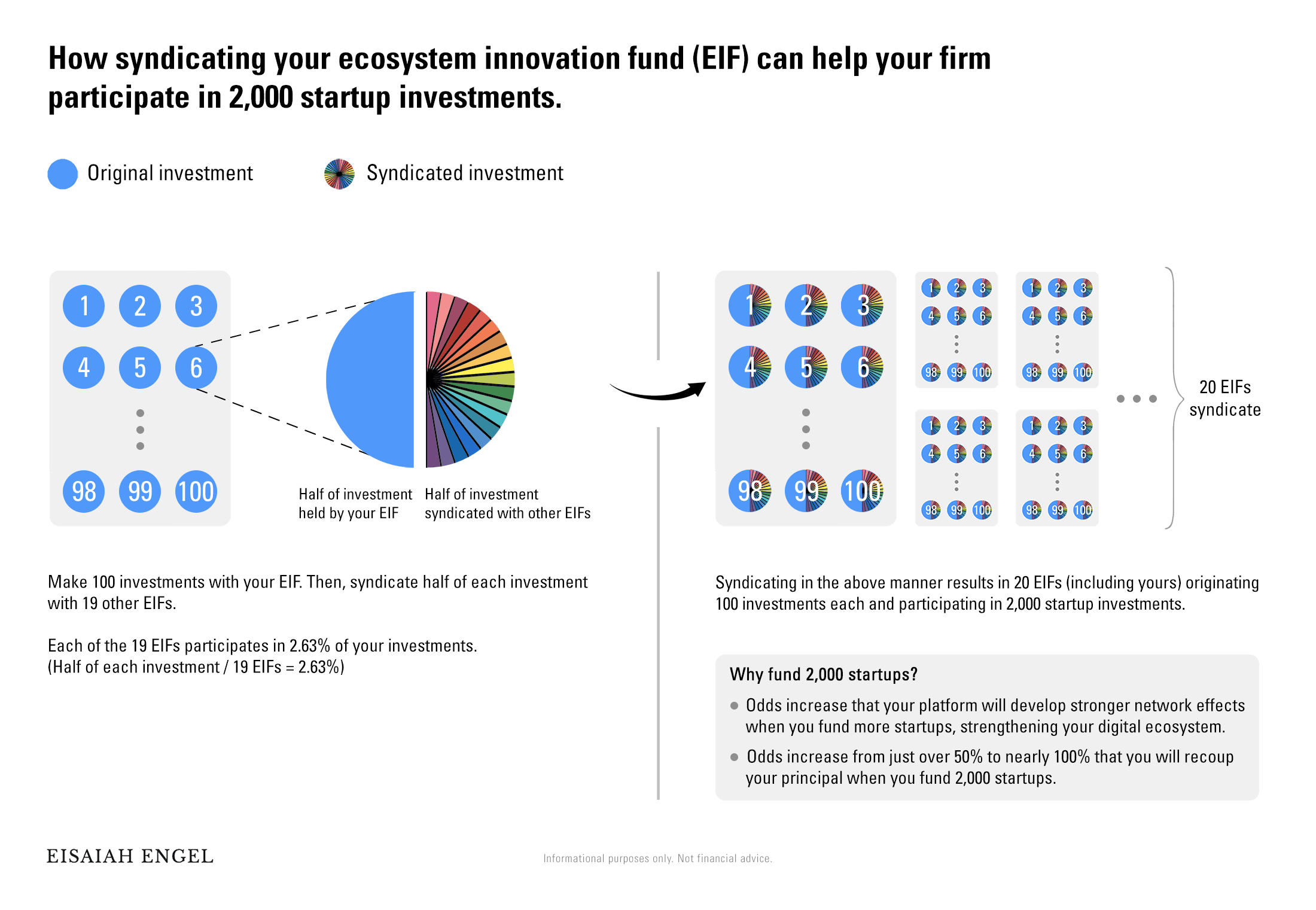

EE: Ecosystem innovation funds change two things about corporate venture capital: size of investment and success ratio. Whereas investments made by corporate venture capital tend to be in the millions of dollars, investments made by an ecosystem innovation fund are expected to be around $50,000. With smaller investments, you can fund more startup “app” developers. Making many small investments can create a self-reinforcing cycle thanks to two market drivers that I explore in Innovation Casino:

1) Odds increase from just over 50% to nearly 100% that you will recoup your principal when you fund 2,000 start-ups.

2) Odds increase that your platform will develop stronger network effects when you fund more start-ups, strengthening your digital ecosystem.

To make many small investments, ecosystem innovation funds use standardised funding processes inspired by the SBIR grant program that I mentioned earlier. Corporate and independent venture capital rarely produce standardized deals because they rely on the “stock picking” skills of fund managers. Yet, standardising your investments allows you to syndicate with the ecosystem innovation funds of your largest supply chain partners. With syndication, you and your supply chain partners can attract thousands of start-ups to your digital ecosystem.

The number of investments you can make is not limited by your firm’s own cash. In fact, an ecosystem innovation fund raises cash from outside investors, which is another difference from corporate venture capital. Outside investors would get principal back from your ecosystem innovation fund’s equity investments and gains from warrants on your company’s stock, which would increase in value as your digital ecosystem grows. Said another way, ecosystem innovation funds turn your digital ecosystem into the “house” of the innovation casino.

“The number of investments you can make is not limited by your firm’s own cash. In fact, an ecosystem innovation fund raises cash from outside investors, which is another difference from corporate venture capital.”

OV: How can corporates adopt the idea of the ecosystem innovation fund, and how can this improve returns from corporate innovation?

EE: By focusing on your core business, you can improve your company’s financial returns. That is why the first step for an ecosystem innovation fund is to categorize your existing products and services as core and non-core. Develop a plan to improve your core offerings by 10X and turn these offerings into your platform that developers in your digital ecosystem can build upon. Capture new ideas with idea management software such as Salesforce IdeaExchange or Plainview Spigit, and label new ideas as core and non-core. Your ecosystem innovation fund serves as a place to plant promising non-core ideas, so you can still benefit from them without distracting your organization. Similar to how SBIR works, a team of less than 10 program managers can write funding solicitations and guide start-ups through the funding process. This risks less capital than your internal teams building non-core ideas by themselves and is an example of playing the innovation casino like the “house.”

While focusing on your core offerings makes sense in theory, doing so in practice will likely require strategic and cultural change. There are consultants who can help your organization adapt. I know that Latitude 55° Consulting are experts in organizational change management and corporate innovation strategy. So, I recommend clients reach out to Latitude 55° Consulting to get started. I also recommend that clients get my book, Innovation Casino. Half of the book is data tables and charts to help you model the financial returns you might expect from an ecosystem innovation fund. Having this data can give you a head start, especially if you do what I recommend by capitalizing your ecosystem innovation fund with external investment and syndicating investments with your supply and distribution partners.

“Your ecosystem innovation fund serves as a place to plant promising non-core ideas, so you can still benefit from them without distracting your organization. Similar to how SBIR works, a team of less than 10 program managers can write funding solicitations and guide startups through the funding process. This risks less capital than your internal teams building non-core ideas by themselves and is an example of playing the innovation casino like the ‘house.'”

About Eisaiah Engel

Eisaiah Engel is a digital innovation expert and best-selling author. Engel’s latest book, Innovation Casino, was born of his struggles to innovate at the extreme ends of corporate structure: first as an entrepreneur and later, as a marketing leader in a Fortune 10 firm. Engel’s research reveals why building a critical mass of startups is how you win with digital ecosystems and how to do precisely that by transferring the approach of the US government’s SBIR grant program to venture capital. Engel lives in downtown Dallas with his wife, Katie and his dog, Maci. You’re likely to recognize Engel by the screen-printed t-shirts he wears of Maci.